In ‘Part 1: Can The Royal Docks Recover From Its Bleak Past’, I take a look at the challenges the Royal Docks are currently facing, and issues overseas investors should consider before putting their money into property in this area.

As a current resident of East London, I’ve found that living in a particular neighborhood gives me not only a good idea of the rents and prices property can command in the area, but more importantly the ‘vibe’ of the community. This could extend from a feel of how quiet streets are when walking home from the DLR station at midnight, to talk on the rents the neighbors are paying, to ‘for sale’ signs put up by a developer when a new housing project is in the works. Not far away from where we live now is one of the most ‘talked-about’ regeneration areas in East London, the Royal Docks area in Zone 3, an estate with a land area of more than 1,100 acres with a water area of nearly 250 acres, and which has steadily been gaining the most attention for the last few years.

What Are the Royal Docks?

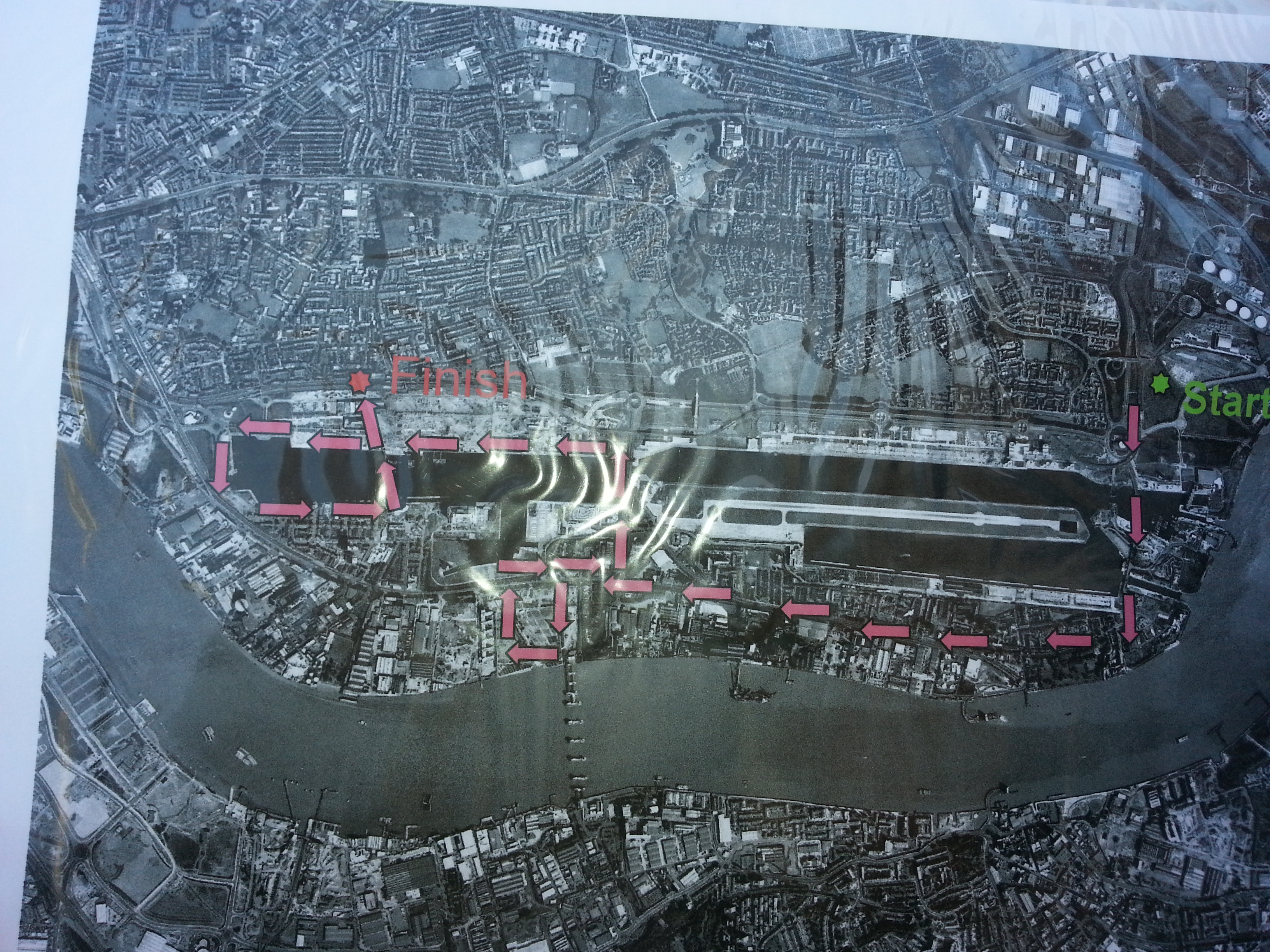

The Royal Docks, a large area comparable in size to the entire central London area from Hyde Park to Tower Bridge, was originally initially built from 1855 to 1921 to cater for large ships bringing in goods from around the world. The Royal Docks are made up of: 1) the Royal Albert Dock, 2) the Royal Victoria Dock and the 3) King George V Dock, all accessible via the DLR train line. I first learnt about the Royal Docks not while I was already living in London, but a couple years ago when I first dropped by a Colliers property exhibition in a hotel in Singapore marketing the Waterside Park development in the regeneration area. The sales agent painted a highly compelling image of the plans for the regeneration area, and I, among many others, were convinced this would be the next big up-and-coming trendy neighborhood in London. However, as always, there are 2 sides to every story, made even more apparent a few weeks ago when I met up with an ex government officer in architecture and planning for the Local Government Authority for the London Borough of Newham, who gave me a one-on-one tour of the area. The goal of the walk was not only to see the ‘glamorous’ parts of the Royal Docks area, but to also gain insights into some of the challenges still facing many blighted neighborhoods deep in the borough, areas which the casual visitor would never see.

Getting To Know … the Royal Docks

We started our walk at the Gallions Reach DLR, where on first sight the area looked like a high-end luxury neighborhood, with luxury apartments overseeing the marina. However, those unfamilar with the are would not be aware that the Crisis Rough Sleepers’ Centre, Ivax Quays, Royal Docks, London, was located right across from the bridge, about a 10 min walk from the marina. This is a home owned by the Crisis Charity and is used to house homeless people suffering from drug and alcohol abuse. I was surprised at how such a beautiful and modern building would be used for such purposes, but I was told the waterfront facilities used to belong to Ivax Pharmaceuticals, who put the building up for sale some years ago and was later acquired by the Crisis Charity. I couldn’t help but wonder if this bit of information was divulged by sales agents marketing properties to foreign investors looking to buy in this area.

We started our walk at the Gallions Reach DLR, where on first sight the area looked like a high-end luxury neighborhood, with luxury apartments overseeing the marina. However, those unfamilar with the are would not be aware that the Crisis Rough Sleepers’ Centre, Ivax Quays, Royal Docks, London, was located right across from the bridge, about a 10 min walk from the marina. This is a home owned by the Crisis Charity and is used to house homeless people suffering from drug and alcohol abuse. I was surprised at how such a beautiful and modern building would be used for such purposes, but I was told the waterfront facilities used to belong to Ivax Pharmaceuticals, who put the building up for sale some years ago and was later acquired by the Crisis Charity. I couldn’t help but wonder if this bit of information was divulged by sales agents marketing properties to foreign investors looking to buy in this area.

The Last Giant Working Factory in London

As with much of London, the Royal Docks area has a long history behind it, and the massive Tate & Lyle sugar refinery plant, Britain’s oldest brand and known the world around for its iconic sugar refining, golden syrup business and the introduction of the sugar cube to the UK, is one outstanding example. However, the dark cloud which currently hangs over the future of the sugar refinery business in the UK is the European Union’s (Common Agricultural Policy) CAP’s protectionist tariff measures for French and German sugar beet growers, making sugar cane, which Britain (and the factory) historically depend on, significantly more expensive. These high EU taxes mean that jobs at the Tate & Lyle factory, which currently employs over a thousand people in the Royal Docks are at stake, and may lead to increased unemployment rates in the local area.

As with much of London, the Royal Docks area has a long history behind it, and the massive Tate & Lyle sugar refinery plant, Britain’s oldest brand and known the world around for its iconic sugar refining, golden syrup business and the introduction of the sugar cube to the UK, is one outstanding example. However, the dark cloud which currently hangs over the future of the sugar refinery business in the UK is the European Union’s (Common Agricultural Policy) CAP’s protectionist tariff measures for French and German sugar beet growers, making sugar cane, which Britain (and the factory) historically depend on, significantly more expensive. These high EU taxes mean that jobs at the Tate & Lyle factory, which currently employs over a thousand people in the Royal Docks are at stake, and may lead to increased unemployment rates in the local area.

The Proliferation of Council Housing in the Royal Docks

Walking around the Royal Docks, Council housing blocks are a common sight, particularly as newer social housing developments are still being built in this area. As developers in London have to reach agreement with local housing authorities before building permission is granted, the council may use the funds raised from the developer to build social housing units further away from the city, and a majority of these units can end up concentrated in areas such as the Royal Docks, where housing is cheaper and less in demand. This means the inner areas of the Royal Docks face many anti-social problems inherent in neighborhoods where a large proportion of residents rely on government welfare payouts. In many areas within the Royal Docks, facilities such as retail stores or coffee shops can be non-existent, as international chains such as Starbucks are reluctant to open outlets in areas where many residents depending on welfare payments are unable to afford that £3 cup of coffee. When I walked by the area on a Sunday afternoon, all the restaurants and shops were closed, and the only supermarket in sight was CostCutters. A group of bored-looking teenagers were kicking around a ball in the local high street, and my companion commented that he would never consider walking around here at night. Prospective investors looking to buy a London property to use as a second home rather than for rental income should definitely keep this mind. That said, the significantly lower prices in the Royal Docks area (compared to West London) would potentially mean very lucrative capital gains and higher rental yields compared to West London in the future when the regeneration finally reaches completion.

The Future for the Royal Docks?

While it may take many more years before the Royal Docks reach their full potential, history has shown time and time again that it is the forward-looking investors who get in at the early stage who make the most money. Back in the early 1990s, those who could see into the long-term and put their money into the then-troubled Canary Wharf, have made doubled or tripled their fortunes by the early 2000s as the property market rebounded. In Part 2: The Long-Term Potential of Royal Docks, I take a closer look at the potential upside, and why investors from around the world are pouring their money into the London Docks Scheme.

This was a very interesting read, thank you! We managed a portfolio of properties for overseas investors throughout the UK with a number being in the Roya Docks! Newham Council have also starting charging a rental license to Landlord which was initially £150 per property however I understand after the 31st January 2013 it was being increased to £500

Dear Natalie, thank you for your comments! We are continuing our efforts to bring research and analysis on up and coming London property markets, particularly in East London, to help investors to perform their due diligence before buying a property.

[…] the Royal Docks certainly faces its share of challenges (as outlined in my earlier blog post, ‘Part 1: Can the Royal Docks Regeneration Area Ever Recover From Its Bleak Past?’), there are many promising signs to indicate that this part of South East London is well on its way […]

Very good article on the Royal Docks. Hope to see more of your entries.

Thanks Jeffrey for the kind comments, glad we were able to help you with your London property research.